Financial wellness tips are funny. If you're like me and spend a lot of your time online then you've likely stumbled upon some pretty unhelpful financial wellness advice, like:

“If you want a house, stop buying avocado toast.”

“Invest in crypto, it's not a pyramid scheme.”

It seems like everyone on the internet has a quick hack to save or make you money but whenever I ask someone what financial wellness means to them in the real world—the answer usually revolves around something simple like net worth, income, or debt. And although these are all technically correct, the truth is that financial wellness is a bit more complex and encompassing—but don't fear! We have some ideas that will hopefully help you achieve financial wellness.

The reality is that achieving financial wellness means different things to different people. The tools and resources we all use may be similar but our financial goals and ideas of success are all very different—and that's okay! We all have different relationships with money and financial wellness is about finding what works best for you.

For example, if you consider the financial well-being of a first year college student versus a parent of four with a mortgage and car payments, they are going to be defined very differently.

This article will help you better understand what exactly financial wellness is, what it means to different people, and how will even include our top financial wellness tips to keep financially fit.

Financial wellness in 3 easy steps! (definitely not clickbait!)

.jpg?width=795&height=447&name=Timeline%20Infographic%20Presentation%20Template%20(2).jpg)

The first step to improving your financial health is being mindful—so congratulations, if you've made it this far, you're on the right path! The second step is to better define exactly what financial wellness means to you. We here at ZayZoon believe it falls under three main categories

- Budget

- Savings

- Eliminating debt

If you can create a plan that budgets your spending and helps you save money while eliminating your debt, you should be set. Unfortunately, this task is easier said than done.

The third step is staying consistent and committed to your plan and making sure it's the right one for you. Your plan should grow and evolve as you do so making necessary adjustments to improve your situation is extremely important.

Financial wellness tip #1: build a budget that works for you

A good budget doesn't need to be overwhelming but it should have you covered for a rainy day. When I think of the “perfect budget” I imagine an old school accountant with a very unorganized desk, vigorously trying to keep track of receipts and bills while frantically trying to make sure all the numbers on his ledger line up. Surprisingly enough, this actually isn't the case but if you feel a similar way, you're certainly not alone in your financial situation.

Budgeting tools for financial wellness

The internet is filled with many great budgeting tools for all types of different budgets. There are apps like mint that essentially do everything for you., simply plug in the proper information and the app will help you track and plan your finances in real-time.

If you like to keep things more of the old-school type, there are plenty of guides that teach you traditional methods of budgeting that still hold up—some of which don't even involve a computer.

If you're somewhere between the app-lover and pen-and-paper type, there are endless tools non-budgeting specific software like excel or google docs to help ease the whole process, while letting you stay fully in control of your financial situation so that you can do things the way you want.

How to track your expenses

Creating a budget is actually relatively simple. It's sticking to said budget that is the true challenge but more on that later. A good budget should take all spending into account, things like: bills, utilities, food, entertainment and clothing. Ensuring all spending is being accounted for is crucial, forgetting to consider even one expense could lead to confusion and frustration.

How to track your income

Once you've determined your expenses, the next step is getting a better understanding of your net income. This should be relatively simple but will depend on your situation. For most, net income is simply how much money you bring home from each paycheck but this could also include other sources such as investments, alimony, side hustles, etc.

After completing your homework and determining your expenses and income, it's time to find a budget that works for you.

Budgeting techniques

Feeling true financial security and finding the right budgeting method is kind of like finding the right sneakers. There are a lot of options out there and they all serve different purposes. Maybe your budget is based on saving money for school, or maybe it's based on spending money on house renovations; either way, there's a budget out there for you.

If you look online, you'll find many different types of techniques. Some of these might work super well for you while others may not, or maybe you need a hybrid option. Here are three of our personal favorites:

Zero-based budgeting

The goal of zero-based budgeting is to make your personal net income equal to zero. The idea is not to spend every dime you make instantly but rather to make sure that you take every dime into account whilst planning and making sure all your money serves a purpose. Whether it's going towards food, an emergency fund, or anything else, it needs to be accounted for to help ensure you stay at zero and don't overspend.

Zero-based budgeting is perfect for the person who really wants to stay proactive and on top of their finances but will involve a little more energy on a regular basis.

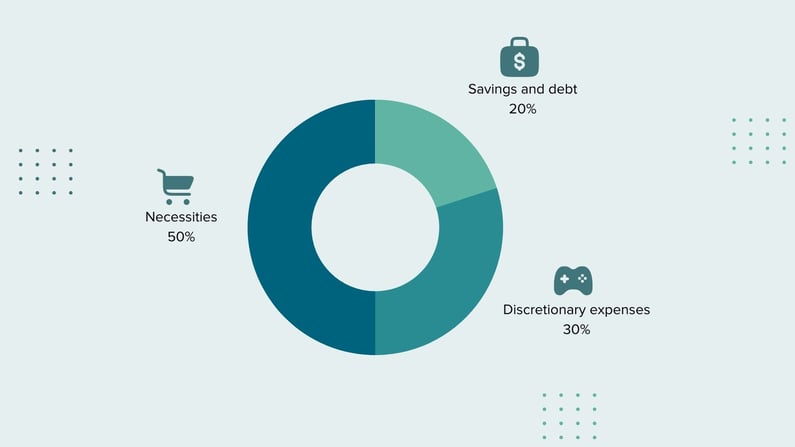

50/30/20 budget

The 50/30/20 rule is a very popular budget style that breaks down your budget into percentages. If the zero-based budget seems a little too hands-on, something similar to the 50/30/20 rule might work a little better for you. There are many different versions of this rule but the most simple form suggests using your money for the following:

-

20% for savings and debt

-

30% for discretionary expenses (entertainment, health services)

-

50% for necessities (groceries, bills, family needs)

Anti-budget budget

This method is relatively simple and straightforward: half your money goes to whatever you deem a necessity, this includes entertainment and other elements most budgets wouldn't normally consider a necessity, while the other half goes to savings, debt and expenses. This is a great strategy for someone just getting started on their saving journey or looking to add more structure to their current situation.

If neither of the previous options sound appealing, maybe the anti-budget budget is all you need. The anti-budget budget requires much less time and energy than most budgets. The idea behind the anti-budget is that you pay your savings, pay your bills, and use whatever is left any way you want. It is essentially about putting your emphasis on prioritizing your expenses and getting the important stuff out of the way first. Once your expenses are paid and you've determined a set amount to put into your savings account each paycheck, the rest is totally up to you.

This is great for the person who wants to stay on top of their finances but doesn't want to worry too much. It should help you stay up-to-date with your finances while requiring minimum effort.

Financial wellness tip #2: staying on top of your savings

Saving money can be hard but it doesn't need to be complicated. Similar to a good budget, the key to saving money is finding what works for you specifically and staying consistent in your efforts. One very important thing to remember is that a little saving is better than no saving at all—it's easy to get a little overwhelmed when first thinking about your long-term financial goals but don't let this discourage you!

Once you have a savings account with an emergency fund set up, a great way to try and stay on course is to look at your savings in three different ways: day-to-day, month-to-month and year-to-year.

1) Day-to-day savings

Day-to-day savings are a great place to start. These spending habits are usually the easiest to change and oftentimes may not seem like a very big deal but it's the day-to-day spending that can very quickly add up on you and it may come as a surprise.

Think of day-to-day spending as the coffee or breakfast you might splurge on some days. This may be a great little treat to help you get through your workday and that's totally fine, however, once you need to start making some financial changes, these are generally the easiest ones to make. These expenses are the ones you might encounter on certain days and not others, the expenses that change on a daily basis.

Be sure to stay mindful of all your day-to-day expenses and determine early on which ones are necessary and which ones are not.

2) Month-to-month savings

Month-to-month saving focuses more on your monthly expenses like your bills, utilities and groceries. Adjusting your monthly expenses can make a major difference in your overall spending but usually doesn't have as much flexibility as your daily expenses.

These expenses are oftentimes a necessity so completely eliminating them usually isn't an option but shopping around for better prices on things like car insurance, phone/cable/internet and pharmaceuticals might really help you save some money long term.

While most monthly expenses are a necessity, there are a few expenses that arise monthly that may be worth cutting down on or completely eliminating. Streaming services or other subscriptions can quickly add up and easily be forgotten about. Be sure to check all your subscriptions regularly to ensure none of them are going to waste.

3) Year-to-year savings

Year-to-year saving is all about your long-term financial goals. These spending habits won't easily be changed so worrying too much about them isn't necessary, however, you need to stay aware of your financial future and make sure your day-to-day and month-to-month plans align. Your year-to-year savings should take all the major expenses into consideration: a car, a home, retirement, investments, etc. These expenses should all be made while consciously considering your future and ensuring you're comfortable with your emergency savings.

Prioritize your long-term goals, whether that be your education, your family or buying a home, then make sure your short-term goals help you get there. Try to set aside some emergency savings and set goals that are SMART (specific, measurable, achievable, relevant, and time-sensitive). While long-term objectives can sometimes feel impossible or far out of reach, SMART goals can help you reach your dreams.

Financial wellness tip #3: eliminate debt efficiently

According to a recent study by the APA, 65% of Americans surveyed said that finances were a significant source of stress. Alleviating this stress is very important—not only for financial wellness but for the overall well-being of the entire country. This starts with eliminating all debt, not just credit card debt. The debt cycle in America is extremely vicious but we here at ZayZoon believe that with the proper resources, guidance and time, anyone can get out of their situation and on the path to financial wellness.

When it comes to paying off debt, there are two major methods: the snowball method and the avalanche method.

1) The snowball method

The snowball method is great for people feeling overwhelmed by their debt and looking to just build some momentum. With the snowball method, the idea is to take the money you've set aside for debt and make the minimum payment on each account. After that, you put the rest of your debt-allocated money toward your lowest balance. The idea is that you will quickly eliminate the first source of debt so that you can focus on the next one. This is a great way to bring you some clarity and help get a grasp on things that may feel like too much.

The only downside to the snowball approach is that it's technically not the most efficient. If your debt is a little less overwhelming and more so just a burden you carry, then paying off debts as quickly and efficiently will be more your speed.

The avalanche method is the quickest and most efficient way to pay off debt but may take more discipline and commitment.

2) The avalanche method

The avalanche method is similar to the snowball method in the sense that you make the minimum payment on each account. The difference between them is that after you've paid the minimum amounts, you then focus on the one with the highest interest rate, not the lowest overall amount. Putting more money into higher interest-rate accounts will save you more money in the long run but will leave you with more to manage.

Once you've chosen the method that works best for you, it's also important to stay in communication with your creditors. You can request due dates that better align with your pay. If you can't make a payment, contact them before your due date and look into the options available to you. Missing a bill payment can have negative effects on your credit and end up costing you more money in the future but some creditors are a little more flexible than you may think. And don't forget to check your credit report! Every twelve months, you're entitled to a credit report. Set up some type of reminder each year to make sure you take full advantage.

Financial wellness tips: final thoughts

Financial wellness doesn't need to leave you feeling overwhelmed. Thinking about your debt, savings and finding the right budget can definitely feel like a lot at times. If you're just getting started or back on your feet there is certainly a lot of moving parts but we really hope that breaking it down into these components—and knowing you're not alone helps ease your soul. Plan ahead and find what works best for you, pick and choose the parts you like, then stay consistent and watch the fruits of your labour grow over time.

Finding financial well-being with ZayZoon

As always, if your employer offers ZayZoon as a benefit, be sure to get the app. It's offered via mobile and desktop. Whether it's getting your earned wages early to cover a bill and avoid late payment fees, tapping into our Perks product to gain extra cash bonuses that stretch your wages further or gaining access to an educational platform that includes tools to help you budget, ZayZoon's got you covered.