PrismHR Live’19

We’re excited to be coming back to PrismHR’s annual user conference for our second year in a row! Lots has happened since last year and what a year it has been. The financial wellness revolution is stronger than ever!

ZayZoon is at the forefront of this. We pioneered the Wages On-Demand space. Wages On-Demand completely changes how employees think of payday. It means employees no longer experience cashflow crunches and are able to avoid overdraft, payday loans and late bill payments. It also provides payroll companies and PEO’s a sales differentiator and revenue share. It’s truly a win-win situation for everyone involved.

Wages On-Demand is a great start, but we’re on a mission to improve employee health through the use of responsible financial products. It’s why now we’ve developed an overdraft predictor, introduced financial education tools and are launching even more features this year.

Still uncertain if ZayZoon is for you? Here’s a rundown on the four major reasons you need to be incorporating On-Demand Wages into your PEO.

Sell more payroll

Let’s face it, payroll hasn’t changed a whole lot in the past 30 years. ZayZoon integrates with PrismHR which means in less than a day we can bolt onto your PEO and arm you with a sales differentiator.

It’s not just a differentiator for you though, it’s also a differentiator for your clients! Wages On-Demand and Financial Wellness through ZayZoon is a no cost benefit for your clients. ZayZoon is used to recruit, retain and increase productivity.

Here’s a couple positions that have listed ZayZoon as a benefit:

All Automated and hands-off

Our integration with PrismHR means once you’re integrated, there’s no administrative work for you or your clients!

It’s also incredibly easy for an employee to use as well!

Revenue Share

We provide a revenue share that goes direct to your bottom line.

Social Impact

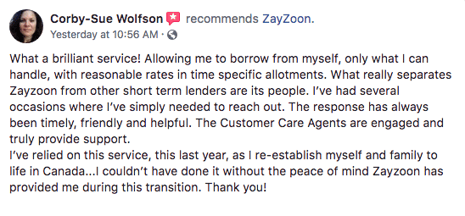

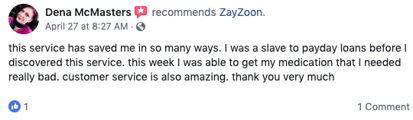

More than 10% of employees use payday loans regularly. Additionally, overdraft is a $30 Billion industry. There is a massive cashflow crunch and the only option for some employees is an expensive solution that places them in a debt spiral. Roughly three-quarters of the entire US workforce lives paycheck to paycheck, hindering people’s ability to garner any sense of financial wellness. Offering these financial advances, which are straight from the wages they’ve already earned, help employees attain a sense of financial well-being. There’s not much better than seeing the life changing reviews from employees