Bad credit! Poor Credit! Guaranteed Payday Loan!

We've all seen the signs. Now they even have payday loans online.

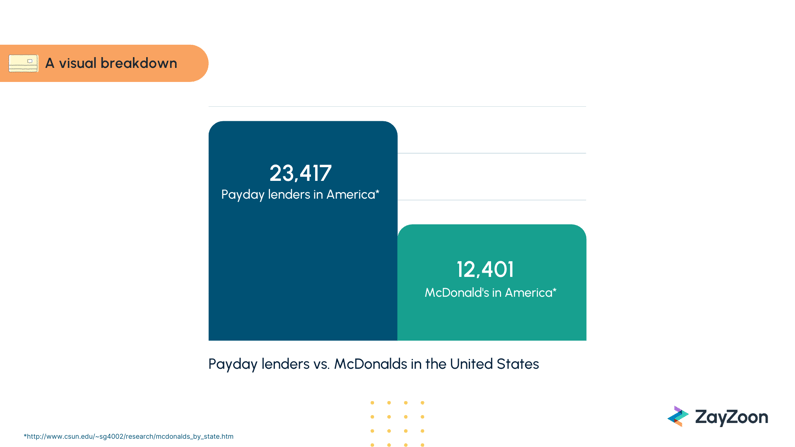

In the United States, there are nearly double the amount of payday loan direct lenders than there are Mcdonald's restaurants—and that's not including online lenders.

For most people, payday loans aren't usually the first choice. Typically, it's the opposite but when you find yourself in a tight financial situation with little money in your bank account, payday loans might not seem so bad.

We're here to remind you—payday loans are so bad.

When times are tough, sometimes you have to resort to things you wouldn't normally do—especially when it comes to feeding your family.

But if you do find yourself in an unfortunate situation where you're considering a predatory lender, we hope you will at least try to consider all the factors and other resources available to you.

But, first:

What is a no refusal payday loan?

No refusal payday loans or guaranteed payday loans as they’re sometimes called, offer people money without a background or credit check. Anyone in need of financial assistance can go to payday loan lenders, make a loan request and have money in their pockets almost instantly.

A direct lender offering bad credit loans with guaranteed approval like that may seem too good to be true.

That's because they are.

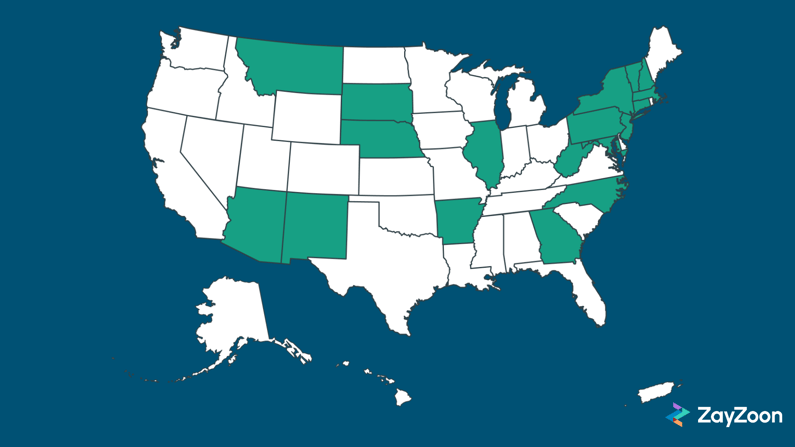

Although the costs advertised by payday lenders typically appear low, payday loans direct lenders are prone to hidden fees and sleazy practices that can quickly add up, which might be why they're banned in 18 states.

Payday loan rates

A typical credit card interest rate is usually between 18-30%. Finding a rate below 18% can be a tremendous financial resource but can be hard with poor credit history.

When it comes to payday loans in states without caps on their interest rates, seeing APRs (Annual Percentage Rates) of 400-500% is not uncommon. Some states like Texas even offer payday loans with fees upwards of 600%.

Background checks

Traditionally, when applying for a loan, the bank will do a background check and credit score. This information usually (but not always) demonstrates your ability to repay a loan.

From there, the bank can determine how much risk is involved in your loan and this is how they determine your interest rate.

If you have good credit and they feel there isn't much risk involved, they'll charge less interest because they feel more comfortable that they will get their money back in a timely manner.

After all, the bank does want to charge the best interest possible to ensure more business.

On the other hand, if you have bad credit and the bank feels as if it will take you longer to pay back your debts, they need to charge more to make sure the transaction is safe and profitable for them.

The main difference between a bank and payday lender, is that a bank genuinely cares about its customers and reputation. Payday lenders simply care about making as much profit, as quick as they can.

It may not always feel like a bank is working in your favor but having them do the proper due diligence and risk mitigation will save you from more financial worries in the long run.

Why do people take out no refusal payday loans?

Although it may be slightly more complex, the simple answer is desperation.

If your car breaks down or a medical emergency arises and you need cash fast, what are you supposed to do?

People don’t proactively incorporate payday loans into their financial plans but when financial issues do come up for a person with poor credit history and they're feeling like they're at their wit's end, there always seems to be a payday lender nearby.

This is how they get you.

Like a mirage in the desert, they appear to be a mystical saving grace... until you read the fine print.

The problem with no refusal payday loans

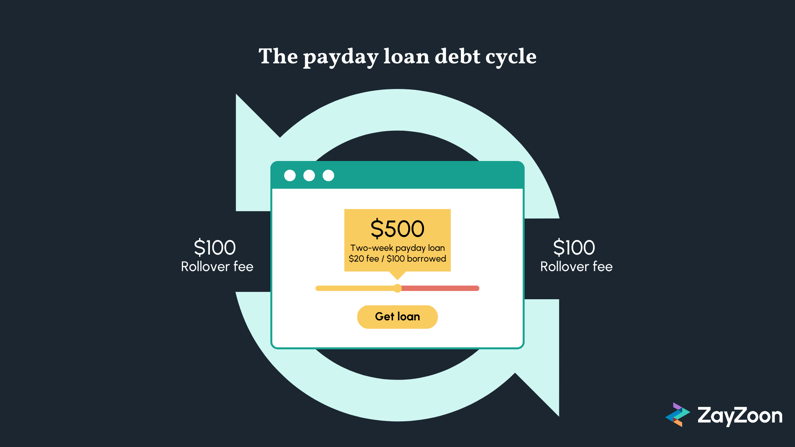

The problem with payday loans is how quickly the interest and hidden fees can add up on you. If you're unable to pay them back on their terms (which are never in your favor) then you end up paying even more money for the money you didn't have, resulting in what we call a debt spiral.

Debt spirals are typically caused when a person with a poor credit score takes out a loan or uses a credit card to pay off their existing debts. This may temporarily relieve the issue in front of them but will then compile even more interest on top of the debt that they're still responsible to pay back.

How to avoid payday loans

The best practice for avoiding hidden fees and unnecessary costs is by being proactive about your finances (and staying away from payday loans, period).

If you're here for some last-minute advice, some of the solutions below may be more beneficial but avoiding payday loans in the future could be as simple as some of these personal behavioral shifts:

Some safer alternatives to no refusal payday loans

If you feel as if your back is against the wall and you need a quicker answer to your financial woes, there still may be some options.

-

Crowdfunding

Crowdfunding is a modern way to raise money for certain situations, whether it be for a charitable act or simply funding a new idea. Crowdfunding sites like Gofundme, Kickstarter or FundRazr allow anyone to create a page with a specific cause where people can make donations.

-

Patreon

If you're not a fan of the crowdfunding concept but have a valuable skill, provide a valuable service or can share valuable information, starting a Patreon could help you cash in.

Patreon provides users with a place to upload essentially any style of content they want (written, video, visual art etc.) behind a paywall. It gives creators the option to upload the content at any monthly subscription fee of their choosing.

-

Etsy

Etsy is an online marketplace where users can sell handmade goods, vintage items, craft supplies and more. This could be a potentially great spot to raise funds for a specific cause or situation.

The solution to no refusal payday loans

You might be thinking, "I need cash fast and I don't have time to wait. Just give me whatever option is the easiest."

This is totally valid, especially when you're in a tight crunch.

But before you decide to go through with it, we hope you take a few things into consideration to ensure you're making the right decision for you.

With so many of them around, avoiding payday lenders isn't always an easy task.

Luckily, there are more options out there for you.

In the past, we've talked about 7 alternatives to payday loans that don't need a credit check and if you haven't already, we definitely recommend checking it out.

In the article, some of the topics we cover are:

-

Credit unions

-

CDFI's (Community development financial institutions)

-

Peer-to-peer lending

-

Personal loans from friends and family

-

Salary advance

These options all offer safer ways to get money fast but should also save you from falling victim to any predatory practices.

No refusal payday loans versus Earned Wage Access

Payday loans can quickly lead to trouble but sometimes the convenience and ease that comes with them is simply too overpowering.

But, what if I told you there was an option out there that's even quicker, more convenient and doesn't lead to a spiraling debt like payday loans?

With ZayZoon and Earned Wage Access, you can access money from your paycheck whenever you need it.

For those of you who don’t know, EWA or Earned Wage Access allows employees to quickly and easily access their pay at any time, in any place. Once we’re integrated with your payroll system, it takes a matter of minutes for your employer to turn our service on.

Instant access to your pay whenever you need it can help smooth out cash flow issues. It makes avoiding late fees, overdraft fees and any other unexpected expenses that may arise a little easier.

If your employer does offer ZayZoon, you can quickly get signed up here.

If your employer doesn't offer ZayZoon, you can send them this link to book a demo or simply tell them to reach out. We always love to chat.