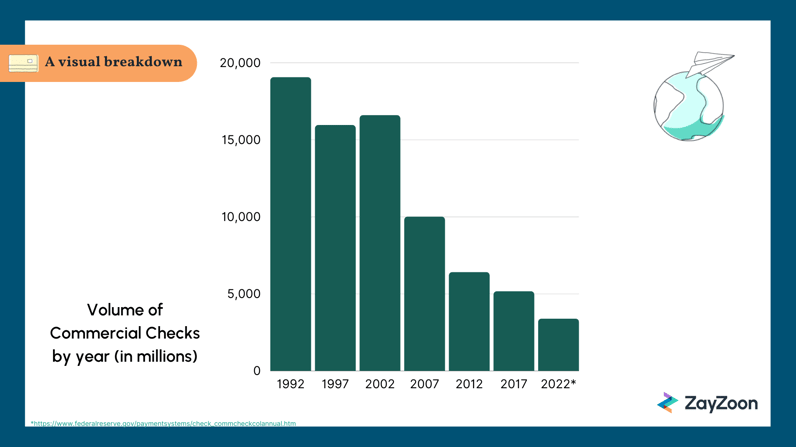

Some experts believe that paper checks will be extinct by 2026.

In the year 2000, there were 42.6 billion paper check transactions. In 2018, paper check transactions only equated to 14.5 billion and continue to drop by an estimated 1.8 billion transactions a year.

Traditionally, employers would process payroll every two weeks and then mail out the money they owed their employees via paper checks. Employees would also use paper checks to make their own personal transactions.

This practice that was once common for everyday interactions like grocery shopping has now been rendered obsolete with the tap of a phone that links directly to your bank account.

Technology has made sending, receiving and paying money easier than ever yet 81% of firms in the United States still use some form of paper check.

So what makes your employees so hesitant to get with the times?

To simplify a complicated answer: The reasons would boil down to familiarity and universality.

"If it ain't broke, don't fix it" is a common and understandable mindset for many tenured business owners and although their methods may not particularly be "broken", there still may be room for improving efficiency and saving money.

It may be time to accept electronic payment and ditch the paper checks.

They've been around for a very long time and getting rid of them may seem like a massive undertaking but we're here to tell you that Earned Wage Access is one of the easiest ways to get your employees off paper checks.

The problem with paper checks

The problem with paper checks is that they take a lot of time to process and send out—and if anything goes wrong in that time, it's back to square one to begin processing and sending out replacement checks.

On top of the valuable time that your team could be spending on more important tasks, each paper check they issue also costs their employer anywhere from $4-$20.

This means an employer with 100 employees would pay a minimum of $7800 a year processing paper checks. Factor in expedited or return to sender costs and that number can very quickly double.

If the cost and time associated with paper checks isn't enough to deter you alone, it may also be worth mentioning that check fraud tied to mail theft is up nationwide.

All with the potential to be a logistical nightmare.

Why is it so hard to get employees off paper checks?

Employers hesitant to make the change are certainly common but not the only factor in moving their business away from paper checks.

Employees also have their reasons for not wanting to switch:

-

They may not have a checking account when they first start working

-

They may not be able to get a bank account

-

It may simply be a personal preference

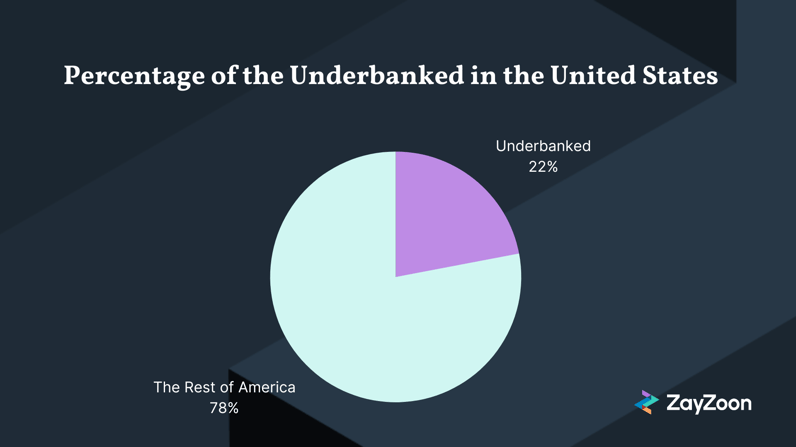

In 2019, 22% of American adults were unbanked or underbanked. Leaving a huge gap in ways they can potentially be paid. For these Americans, paper checks may seem like the easiest option and in many circumstances, this is true.

To cash these checks, the unbanked must physically go to a check casher and then are subject to some pretty unfavorable fees. Costing that unbanked employee unnecessary time and money.

The plight of the unbanked or underbanked is well known, but in many cases, folks don’t have a bank account because they aren’t able to qualify, or the ongoing fees and minimum balance requirements for an account are not tenable.

What are HR professionals doing about paper checks?

With current workforce trends and unemployment numbers, HR professionals have a lot on their plate—to say the least.

They've been working extra hard on their recruiting and retention efforts on top of their typical day-to-day responsibilities. Which can be exhausting at times.

With so much going on, it's fair to say that although HR pros might be all for ditching paper checks, jumpstarting that transition may not be at the top of their priority list.

Spearheading the transition from paper checks to direct deposit can certainly appear to be overwhelming, especially with a small HR team. Unfortunately, these same small businesses are the ones who need direct deposit the most.

A team full of employees being paid via direct deposit drastically reduces the time and energy spent on payroll, reduces the risk of fraud or human error and improves your team morale and productivity.

EWA: The silver bullet

How does Earned Wage Access help employers and employees get off of paper checks?

One strategy is to incentivize direct deposit to Earned Wage Access users. Since we know that 70%+ of hourly employees would like the ability to get paid as they work, this is an effective strategy to get the employees who do have a bank account to choose direct deposit to receive their paychecks.

Incentives

- Offer employees discounted fees for on-demand pay if they enable direct deposit.

- We’ve had clients offer employees sign-up bonuses for setting up their EWA account and switching their payroll to direct deposit

Work with an EWA provider that has a virtual mobile prepaid debit card

- Employees can sign up for the card in-app, and at least have a virtual card instantly. Direct deposit can be switched to this card immediately and a physical card is delivered directly to the employee

- This can be self-serve as part of employee onboarding—without the requirement of administration from payroll

Work with your EWA provider and your payroll card provider

- If you can’t mandate that pay needs to go to direct deposit, make EWA more accessible for pay card employees

- Offer lower fees or fee-free advances to the payroll card to help drive adoption

As earned wage access evolves, we see it providing solutions to employer and employee challenges beyond easy access to earned wages.

Work with your EWA partner to build an effective communication and incentive strategy to get all employees on direct deposit, saving you time, effort and money while providing a better workplace experience for employees.

Out with the old, in with the new

Paper checks are going the way of the dinosaur—and for very good reason: paper checks are 10x more expensive than making payments digitally.

One way savvy HR pros are getting their workforce off paper checks is by offering on-demand pay. It incentivizes the transition while giving employees the option to get paid whenever and however, they want.

Although we firmly believe that direct deposit is the superior method for paying employees, it is important to recognize that it’s not quite a flawless system. Bank accounts vary but a few minor downsides worth considering are:

-

You can’t stop the payment like you can with a paper check

-

Changing banks means changing bank info

-

Employees changing bank accounts will need to resubmit new info and keep old account open while final payments come through

When it comes to choosing direct deposits or paper checks, the answer seems pretty obvious. It may not be a perfect system but we do believe the pros outweigh the cons. If your initial hesitation comes solely from implementation, then let ZayZoon help.

Reach out today to learn more.