Addressing myths, misconceptions and the future of financial empowerment

Like many new services today, there are some misconceptions, or myths, floating around the market today about EWA, so we wanted to clear up any confusion.

We sought out experts to hear what they had to say about the most common EWA misconceptions to make things easier for anyone trying to learn more about the service or today’s financial empowerment space.

We’ve compiled findings from global external financial research leaders like Visa, payroll leader ADP, along with statements from government bodies like the Consumer Financial Protection Bureau, Consumer Federation of America and the United States House Committee on Financial Services. We also sat down with some of ZayZoon’s internal EWA legal, operational and product experts.

An important note

Every provider of EWA is different, not all providers and models are the same. There is great product diversity in the EWA space. Unfortunately, some payday loan providers have disguised themselves as legitimate EWA providers.

So, what we explain here is applicable to Earned Wage Access models like ZayZoon’s.

In this piece, we’ll tackle:

- Myth #1: EWA works just like a loan

- Myth #2: EWA has similar fees as a payday loan

- Myth #3: EWA poses an increased risk to consumer privacy

- Myth #4: EWA doesn’t actually impact employee retention

Myth #1: EWA works just like a loan

There are critical differences between EWA and loans.

Basis of service

This is the most important distinction between Earned Wage Access and any kind of loan.

EWA gives your employees access to funds they've already earned, but have not yet been paid due to the traditional pay cycle (e.g. bi-weekly or monthly).

So, similar to a traditional employer-provided pay advance, it’s not borrowing. It’s receiving the money you have already earned by working, but in advance.

The delayed bi-weekly or monthly payroll cycle you use today actually comes from the introduction of a mass payroll tax for employers in World War II and is based on employees lending their employers money in the short term. Learn more in “Your employees are doing you a huge favor” by ZayZoon's VP of Product, Shayan Rahnama.

So, again, for all the people in the back: Earned Wage Access does not work like a loan because it is your employee’s own money.

Loans vs. EWA

A loan includes borrowing (usually larger sums) of money the borrower may or may not be able to pay back. This risk is why loans require interest and, more often than not, a credit check (but more on that later in this section).

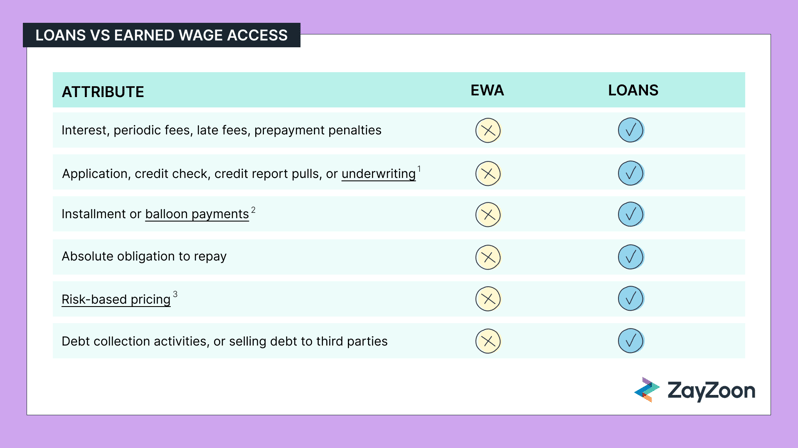

Here are some other key differences between the two:

¹ Underwriting: determines risk for a loan. If the risk is considered worth taking, the underwriting process reviews things like credit scores, history, income or assets to determine how much to charge for the loan.

² Balloon payments: “a larger-than-usual one-time payment at the end of the loan term.” If a mortgage has a balloon payment, payments (or installments) may be lower for many years, but a big amount at the end of the loan will be owed.

³ Risk-based pricing: when lenders offer borrowers different interest rates or other loan terms, based on the estimated risk that they will fail to pay back their loan. Lenders will generally offer a higher interest rate to those deemed “high risk” (low credit score or behind on mortgage).

“These attributes are hallmarks of loans… and are put in place as protections for creditors. None of these exist for models like ZayZoon’s Earned Wage Access.” - Garth McAdam, JD, Legal Counsel at ZayZoon

Why do some EWA options include a transaction fee?

If EWA is accessing money you’ve earned by working, why is there a fee? Simply, it’s a service. Here’s why:

- Payroll services don’t currently have the flexibility or tech capabilities to give you your money on demand

- Employers bring in 3rd party vendors to help get around these limitations, like ZayZoon

- These vendors build technology that have costs associated with them, like most other services

When are employees charged a fee? Only when employees use the service in a given pay period. If they choose not to access their earned wages early, they will receive their pay as normal.

Many EWA providers, including ZayZoon, have fee-free options (more on that in Section 2).

Regulations and legislation

There is support for the idea that EWA should not be classified as a loan at both the federal and state level.

The Consumer Financial Protection Bureau has acknowledged as early as 2017, that EWA is a tool that helps employees with financial strain, unexpected financial events, and budgeting.

The Consumer Financial Protection Bureau (CFPB) also issued an advisory opinion in November 2020 clarifying that certain Earned Wage Access products are not considered to be an extension of credit under the Truth in Lending Act.

Sherrod Brown, the Chairman of the Senate Banking Committee, stated that "employer-based earned wage advances with strong consumer protections can, in fact, help workers cover unexpected expenses or emergencies” at the New Consumer Financial Products and the Impacts to Workers senate hearing.

At the Modernizing Financial Services Through Innovation and Competition hearing, French Hill, the Vice Chair of the United States House Committee on Financial Services argued that:

“Earned Wage Access products allow people to—as the name suggests—access their wages as they earn them. This can give people the flexibility and liquidity to meet short-term credit needs, like when a bill is due next week but payday isn’t until the end of the month.”

Missouri and Nevada have passed laws that deem EWA a pay-advance, not a loan. Georgia, South Carolina, North Carolina, New York, Texas, Virginia, Wisconsin, and Vermont have all considered similar laws.

Credit checks

If you have ever gone to the bank for a loan or credit card you know they do a credit check. If you have also ever not been able to make a payment on a loan or credit card you know that impacts your credit score.

Some payday loan providers do require a credit check, some do not. Payday lenders are more interested in proof of income.

EWA models like ZayZoon do not require a credit check as employees are accessing their own wages. We believe this is a must for any legitimate EWA provider. Proof of time and attendance at work, or some other proof of employment, is the only thing needed instead of a credit check.

Impact on credit score

The impact on your employee’s credit score is another key difference between EWA and loans. Personal and payday loans lenders will contact collections when borrowers don’t pay back their loan. This can negatively impact their credit score making accessing future financial and housing opportunities more difficult in the future.

Earned Wage Access providers with models like ZayZoon will never report employees to credit bureaus or send anything to collections.

At ZayZoon, our goal is to financially empower your employees. We believe their financial wellness should not be negatively impacted by using our services in any circumstance.

Direct integration with employers

Another critical difference between EWA models like ours and loans is how they’re offered, and by who.

Loans are offered through banks or credit unions or service shops such as Title Loan and Payday Loan shops.

EWA services like ZayZoon are often provided in partnership with your company and their payroll system. Businesses just like yours offer this as a financial wellness service or benefit to employees.

“We link to payroll systems that give us a real-time feed of an employee's wages. We can then extend those funds to employees. Then the repayment that occurs is actually by way of that payroll deduction as well.” - Tate Hackert, President and Co-founder of ZayZoon

Employee financial empowerment

ZayZoon’s Earned Wage Access is further offered through an employee financial empowerment platform that includes additional financial literacy and wellness services like:

- Financial education services and resources such as an easy-to-use budgeting and home affordability tool and retirement analyzer

- Smart insights based on employee income, spending habits and expenses

- Customized alerts that employees can set to notify them when they’re at risk of incurring minimum balance or overdraft fees

Learn more about ZayZoon’s employee financial wellness tools.

Myth #2: EWA has similar costs as a payday loan

ZayZoon’s EWA was actually created as a solution to predatory payday loans. It was designed to help employees manage unexpected expenses or cash flow issues without the need to take out high-interest payday loans or incur overdraft fees from banks.

The difference is clear if you look at the numbers, so let’s compare.

Payday loan: compounding and growing interest

Payday loans, according to The Consumer Federation of America report published in 2023, include the following fees:

- 400%+ annual interest (APR).

- 390% to 780% APR on short-term payday loans (2-weeks).

- APR can exceed 780%, in states that do not cap the maximum cost (like Texas, South Dakota and Idaho).

- In Texas, a $500, four-month installment loan costs $645 in finance charges at an APR of 527%. The borrower ultimately repays $1,145 (Pew Trusts).

- On average across all states, charges range from $15 to $30 for every $100 borrowed.

The maximum amount you can loan using a payday loan is state dependent, but most state’s maximums range from $500-$1000. Further, as payday loans providers don’t communicate with one another, borrowers could exceed these limits by getting different loans from different providers.

EWA: flat and minimal one-time fee

Here’s what EWA fees and costs look like, on average (many EWA providers do have fee-free options, ZayZoon’s options can be found below):

- Includes a flat and minimal fee

- Average $2.59 - $6.27 per transaction

- Never includes interest

- Withdrawal limits of $200/transaction (fee is 2.5% per transaction)

ZayZoon’s Earned Wage Access charges $0 - $5 to employees, and only when they use the service.

Think of that fee as similar to an ATM fee for taking out cash at a bank that is not your own. It’s a flat charge for another institution processing a transaction. Another similar example is Uber’s Instant Pay system. Drivers can cash out earnings up to five times a day for a flat $1.49 transaction fee.

But is EWA a solution to predatory payday loans?

We interviewed 637 of our customers earlier this year (2023) to find out.

- 37% of ZayZoon customers report using payday loans prior to ZayZoon

Of the 37% that had used payday loans:

- 61% report using payday loans less than they used to with ZayZoon

- 29% report a reduction in payday loan use of more than 2x per month

- The average reduction is is 1.35x per month

ZayZoon free-fee options

ZayZoon also offers other flexible (and fee-free) pay options, including:

- Prepaid ZayZoon Visa card: a digital card issued to employees almost instantly. Acts like a debit card, allowing employees to spend a preloaded balance with their earned wages.

- Gas Card: It has no fees, gives a 5% bonus on every fuel purchase, and includes an extra $5 on first payout—turning every trip to the pump into savings.

- Instant Gift Cards: Through partnerships with some of the nation’s top merchants (think: Amazon, Instacart, Walmart, etc.) employees can receive their pay via Instant Gift Cards—with an added up to 25% savings.

Repayment structure

It’s no secret that people today are struggling with inflation and their finances. 60% of Americans are living paycheck to paycheck. 51% of people who earn more than $100,000 reported living paycheck to paycheck in the U.S. today.

This, of course, impacts your average employee's ability to pay back payday loans.

Nearly 1 in 4 payday loan recipients take additional loans, up to nine times, to pay back their initial payday loan according to the Consumer Financial Protection Bureau.

This is where payday loans get dangerous due the impact to your employees credit, fees and interest previously mentioned. Borrowers often take out more loans so that they can pay back the previous ones. Fees are charged each time they extend their loan and often put borrowers in overdraft—it doesn’t take long before those charges exceed the initial loan amount.

With ZayZoon’s Earned Wage Access, there are no hidden or additional fees like periodic fees, late fees, or prepayment fees. All advances are non-recourse, meaning nothing will ever be sent to collections.

As ZayZoon gets repaid off payroll (not your employees bank account), there is never risk of an overdraft occurring from a repayment to ZayZoon.

“Employees are never at risk of an overdraft fee from us, or taking money from their bank account, or debiting money from their bank account. This can happen with a payday loan or direct to consumer products.” - Tate Hackert, President of ZayZoon

DailyPay, another EWA provider with a similar model as ZayZoon, explains, “payday loans often have hidden fees or interest payments that can leave the borrower in debt… (EWA) enables you to access your earnings before payday, and there is no loan to repay of any kind. This is your money.”

Myth #3: EWA poses an increased risk to consumer privacy

Every EWA provider has their own unique data and privacy policy, so we can’t comment on them all. However, we can say that ZayZoon follows industry best practices when it comes to data and privacy. As a result, we don’t pose an increased privacy risk to consumers.

ZayZoon prides itself on being a safe and trustworthy place for your data. We maintain SOC 2 Type II compliance and are regularly evaluated by auditors with the American Institute of Certified Public Accountants (AICPA).

We’ve never sold customer data, and never intend to. Protecting customer data has been a priority for ZayZoon since its inception in 2014.

We also take reasonable data protection measures, including: firewall barriers, SSL encryption techniques, and authentication procedures, to help protect personal information from loss, theft, misuse, and unauthorized access, disclosure, alteration, and destruction.

Data and privacy are both important to the team at ZayZoon. Read our full privacy policy and security posture report to learn more.

Opt-out of data storing

For our no-fee gift card options, described above, employees share their information with our retail partners for advertising purposes. The information shared is similar to when shopping online.

ZayZoon customers can easily contact our customer service team to have their information deleted and removed from both our system and our gift card partners.

Getting in touch

Have questions or feedback? We'd love to hear from you: support@zayzoon.com.

Myth #4: EWA doesn’t actually impact employee retention

As you know, employee retention is a multifaceted challenge. And, we don’t think Earned Wage Access is a magical silver bullet that can fix it alone at every business.

However, EWA is a critical piece in the puzzle of comprehensive financial wellness tools that address the immediate needs of your employees.

From what our employer partners and research tell us, EWA is a significant draw for today’s employees to join your business and stick around. Today’s employees want to work for employers that understand, value and are responsive to their financial wellbeing.

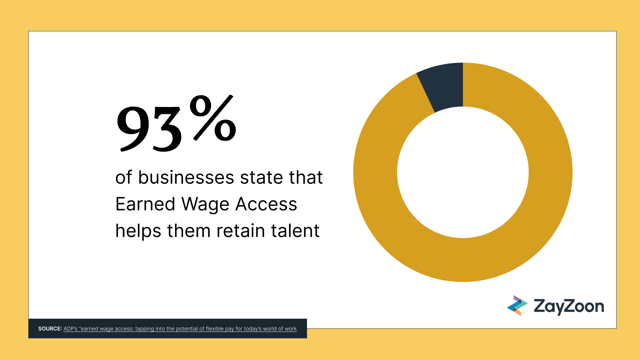

For ADP’s “Earned Wage Access: Tapping into the Potential of Flexible Pay for Today’s World of Work'' report, they interviewed 600 businesses and 1,000 workers. They found:

- 96% surveyed businesses stated EWA helps them attract talent

- 76% of surveyed employees across all age, education and income levels said it was important for their employer to offer EWA.

- 93% surveyed businesses stated EWA helps them retain talent

In Visa’s 2023 “On-demand pay: Meeting the Needs of an Evolving Payment Landscape” report, Visa revealed that companies with Earned Wage Access saw:

- 50% reduction in turnover and increased worker satisfaction

- 89% reduction in financial stress

- 78% said that the availability of ZayZoon’s EWA motivates them to perform and be productive at work

Visa added that EWA addresses an “unrealized need among workers, leading to substantial adoption when it is offered.”

A path to a financially empowered future for the everyday employee

French Hill, the Vice Chair of the United States House Committee on Financial Services, compared the innovation of EWA to ATMs 50 years ago at the Modernizing Financial Services Through Innovation and Competition hearing:

“Think of the humble ATM, which changed the way we thought about cash and credit 50 years ago… Like the ATM, I believe that FinTech today has the potential to drive even greater innovation in financial services, while also delivering even more customer-centric experiences based on trust, convenience, and service in an increasingly digital world.

The massive rise in popularity of these kinds of financial products demonstrates that consumers already recognize how these innovations are improving their own lives.”

The road to our society fully embracing the power of a new technology or innovation is most often full of anxieties, misconceptions and other bumps in the road. Especially if that new innovation involves personal finances.

We’re excited about this journey and EWA’s role in creating a future where financial stress is no longer an inevitable aspect of the working world. And, we think you should be too!

If you want to talk to a real human being and ask questions about these myths or learn more about financial wellness programs and Earned Wage Access or how ZayZoon can help you empower your employees feel free to get in touch. We’re always happy to talk.